Buy now, pay over time.

Make monthly payments with no hidden fees.

Q: How does Affirm work?

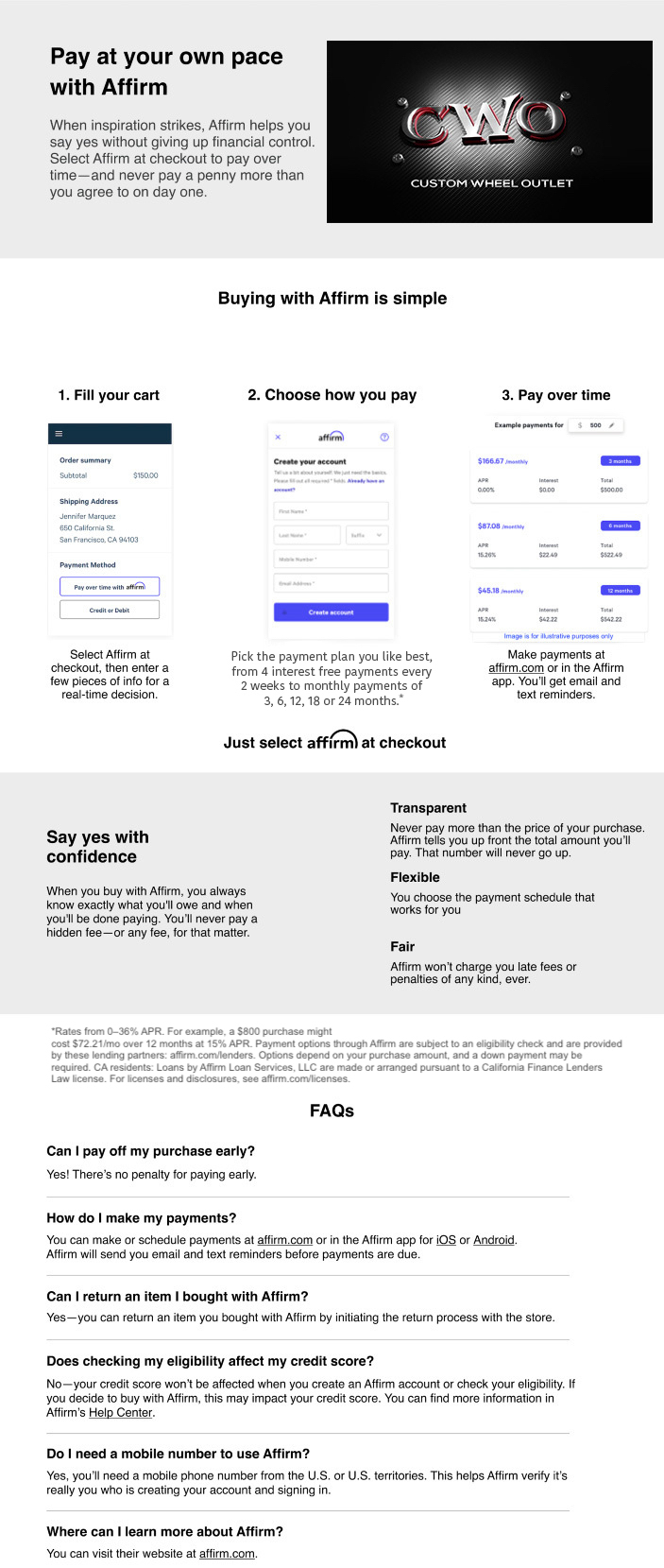

Affirm loan-application process steps:

1. At checkout, choose Pay with Affirm.

2. Affirm prompts you to enter a few pieces of information: Name, email, mobile phone number, date of birth, and the last four digits of your social security number. This information must be consistent and your own.

3. To ensure that you're the person making the purchase, Affirm sends a text message to your cell phone with a unique authorization code.

4. Enter the authorization code into the application form. Within a few seconds, Affirm notifies whether or not your application is approved, the interest rate, and the number of months you have to pay off your loan. You have the option to make 4 interest free payments every two weeks or pay your loan over three, six, twelve, eighteen, twenty-four or thirty-six months.

5. To accept Affirm's financing offer, click Confirm Loan and you're done.

Disclosure Guidance:

*Rates from 0–36% APR. For example, a $800 purchase might cost $72.21/mo over 12 months at 15% APR. Payment options through Affirm are subject to an eligibility check and are provided by these lending partners: affirm.com/lenders. Options depend on your purchase amount, and a down payment may be required. CA residents: Loans by Affirm Loan Services, LLC are made or arranged pursuant to a California Finance Lenders Law license. For licenses and disclosures, see affirm.com/licenses.

After your purchase, you'll receive monthly email and SMS reminders about your upcoming payments. You can also set up autopay to avoid missing a payment. Your first monthly payment is due 30 days from the date that we (the merchant) processes your order.

Q: How does Affirm approve borrowers for loans?

- Affirm asks for a few pieces of personal information: Name, email address, mobile phone number, date of birth, and the last four digits of your social security number.

- Affirm verifies your identity with this information and makes an instant loan decision.

- Affirm bases its loan decision not only on your credit score, but also on several other data points. This means that you may be able to obtain financing from Affirm even if don't have an extensive credit history.

Q: Does Affirm perform a credit check? Does it impact my credit score?

Although Affirm performs a credit check when you apply for a loan, this won't impact your credit score. However, if you're approved and decide to buy with Affirm, your loan and payments may affect your credit score. Paying on time can help you build a positive credit history.

Q: Why was I asked to verify my identity?

If Affirm has difficulty confirming your identity, you may need to provide more information. Affirm uses modern technology to confirm your identity, including verifying your address or full SSN, or requesting a photo of your ID. Affirm takes these steps in some cases to counter fraud and provide the most accurate credit decision they can.

Q: How do I make my payments?

Before each payment is due, Affirm sends you an email or SMS reminder with the installment amount that is coming due and the due date. You have the option to sign up for autopay, so you don't risk missing a payment.

Follow these steps to make a payment:

1. Go to www.affirm.com/account.

2. Enter your mobile phone number. Affirm sends a personalized security PIN to your phone.

3. Enter this security PIN into the form on the next page and click Sign in.

4. After you sign in, a list of your loans appears, with payments that are coming due. Click the loan payment you would like to make.

5. Make a payment using a debit card or ACH bank transfer.

Q: If I return an item, how do refunds work?

A refund posts to your Affirm account if we process your refund request. In the event that we issue you store credit instead of a refund, you are still responsible for paying off your Affirm loan.

If you have already made loan payments or a down payment, Affirm issues a refund credit to the bank account or debit card that you used to make the payments.

We do not refund any paid interest.

Q: How long does it take to get my money back in the event of a return?

A refund credit appears in your account within three to ten business days, depending on your bank's processing time.

Q: Can I amend my order after my purchase has been processed? Can I be approved for a higher loan amount if my purchase amount increases?

You cannot edit your order after you have confirmed your loan. If you want to add items to your purchase, apply for another loan with Affirm or use a different payment method.

Q: Am I able to obtain a refund after my purchase?

Refunds can be processed up to 365 days from the date your order is placed.